salt tax cap repeal senate

House of Representatives passed a partial repeal of the SALT cap by a vote of 218206 with five Republicans voting for the bill and 16 Democratsmainly progressives. Makes in order a.

House Democrats Propose Increasing Salt Cap To 72 500 Through 2031

The Labour Party Labour Central Kings Manor Newcastle upon Tyne NE1 6PA Promoted by David Evans on behalf of the Labour Party both at Southside 105 Victoria Street London SW1E 6QT.

. Now the bill will move to the Senate where all Democrats must rally together to pass the legislation through an evenly divided chamber. Agreed to by record vote of 219-208 after agreeing to the previous question by record vote of 219-208 on August 12 2022. Passed the Senate as the An Act to provide for reconciliation pursuant.

The new House bill would raise the State and Local Tax SALT deduction by increasing and applying the cap over the long-term so that states and counties could get more revenue for essential public. House Democrats concede line in sand over ending SALT cap The fight over the 10000 cap on state and local tax deductions has been pronounced in Northeastern states and California where. It passed 57-43 with seven.

The Senates Inflation Reduction Act is headed to the House this week Speaker Nancy Pelosi is quickly convening her troops and it looks as if a debate over the SALT tax cap wont prevent or even delay final passage. For example there is no limitation or repeal of section 1031 like-kind exchanges no increase in the capital gains tax rate no changes to the current rules on the step-up in basis of capital assets at death and no expansion of the 38 net investment income tax. The Senate passed Senate GOP Whip John Thunes amendment to fix a tax issue in Democrats social tax and spending bill which includes an extension of the SALT cap.

Breaking Local News NEXT Weather Community Journalism. SALT refers to the state and local taxes that taxpayers can deduct from their gross annual income when filing federal taxes. Provides for the consideration of the Senate amendment to HR.

1 by Kevin Brady RTX on November 2 2017. The 740 billion package that narrowly passed the Senate on Sunday includes tax credits for clean energy increased subsidies for health insurance premiums and higher taxes for some corporations. Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent Inflation Reduction Act.

The Senate-passed climate change and health care bill does not address the Republican tax laws 10000 cap on. The Salt March also known as the Salt Satyagraha Dandi March and the Dandi Satyagraha was an act of nonviolent civil disobedience in colonial India led by Mahatma GandhiThe twenty-four day march lasted from 12 March 1930 to 6 April 1930 as a direct action campaign of tax resistance and nonviolent protest against the British salt monopolyAnother reason for this. The fight over the 10000 cap on state and local tax deductions has been pronounced in Northeastern states and California where property taxes are highest in the nation.

After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say theyll vote for the partys spending package without. Our tax code should not favor red state or blue state elites with loopholes like. TV WATCH LIVE WATCH IN THE APP.

Joe Manchin D-WVa halted the plan in the Senate. Senate Majority Leader Chuck Schumer D-NY has expressed interest in repealing the SALT cap which was originally imposed as part of the Tax. Passed the House of Representatives on November 16 2017.

REPORTED BY A RECORD VOTE of 9-4 on Wednesday August 10 2022. Introduced in the House of Representatives as HR. Passed committee on November 9 2017 as Tax Cuts and Jobs Act 2416.

A group in the Senate tried. With a focus on Asia and the Pacific ABC Radio Australia offers an Australian perspective. Our content on radio web mobile and through social media encourages conversation and the.

FLOOR ACTION ON H. Gottheimer said in an interview that the Inflation Reduction Act is a victory in his continued push to repeal SALT because Democrats beat back attempts to raise income. Many of these same Democrats won their seats after launching aggressive attacks against Republicans for voting for the 2017 tax package that.

Democrats from high-tax blue states are insisting on the repeal of a rule that limits state and local tax SALT deductions to 10000 which was. Although House Democrats in November passed an 80000 SALT cap through 2030 as part of their spending package Sen. In unveiling the Inflation Reduction Act in late July he broadcast his firm opposition to including any provision to repeal the SALT cap.

After the Senate passed their signature climate tax and healthcare package Sunday the action turns to the House. In November 2019 the US. Many of these same Democrats won their seats after launching aggressive attacks against Republicans for voting for the 2017 tax package that.

The amendment would be paid for by a one-year extension of the cap on state and local tax deductions SALT that was a key feature of the 2017 Trump tax cut and which Schumer pledged to repeal as. As President Joe Biden and policymakers in Congress consider changes in tax policy over the coming year the fate of the 10000 state and local tax SALT deduction cap will be an ongoing part of the policy debate. Committee consideration by House Committee on Ways and Means.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Hopes Dim For Lifting Salt Cap In Senate Deal Route Fifty

Why This Tax Provision Puts Democrats In A Tough Place Time

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

Lawmakers Can T Reconcile Weakening The Salt Cap With Progressive Goals The Hill

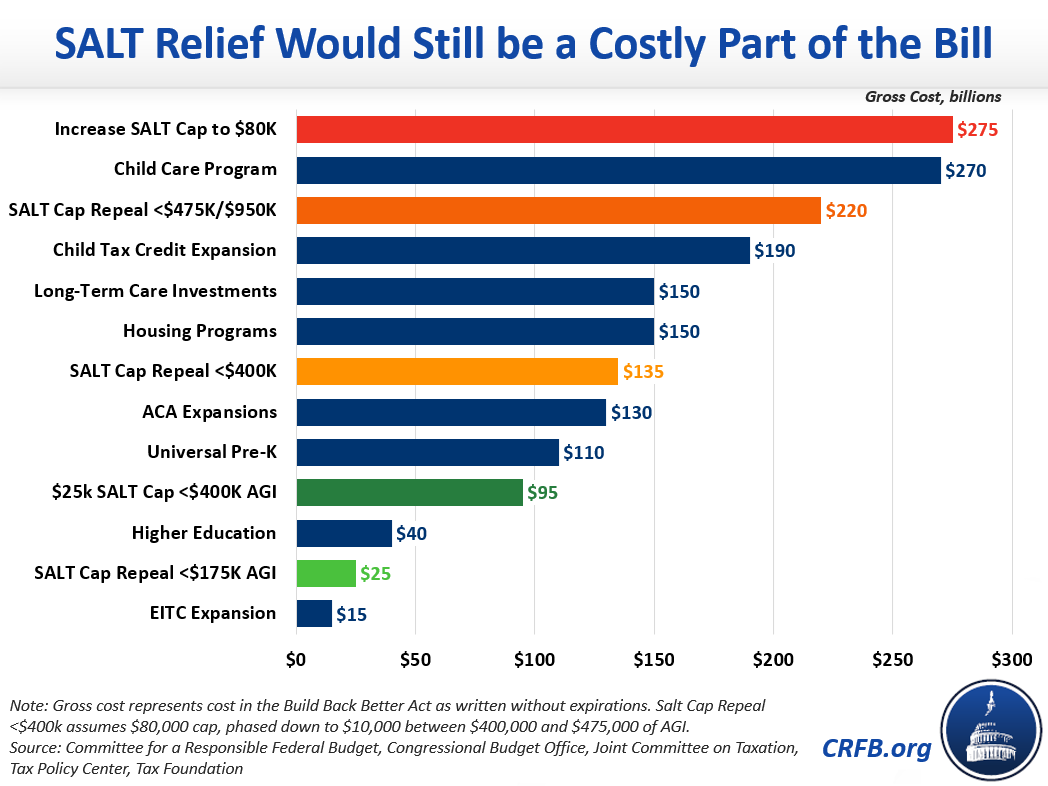

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Manchin Spurns Salt Cap Expansion In New Economic Agenda Bill Bnn Bloomberg

Pin By Frank Valdez On Coin Sanders Cap Upper Middle Class

Salt Cap Confounds House Democrats Crafting Taxes For Biden Plan Bloomberg

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

House Democrats Concede Line In Sand Over Ending Salt Cap

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Salt Cap Repeal Gains Steam Amidst Uncertainty Bond Buyer

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Chuck Schumer Salt Deduction Cap Repeal Tax Bailout For Rich Liberals National Review

Salt Cap Repeal Gains Momentum With House Bipartisan Caucus Bloomberg